As we move away from the peak of the COVID-19 pandemic, hospital decision-makers in the Asia Pacific region have more breathing space to plan for the future. Instead of equipment and systems for COVID-19 diagnosis, management and treatment, there are new priorities. The backlog of elective procedures is top of the list, meaning hospitals will need to upgrade their equipment to stay on top of this added pressure.

LEK Consulting are a global consultancy firm that produces impactful reports for the healthcare industry.

In this London Agency article, we will look at the report prepared by LEK Consulting: APAC Hospital Priorities 2022: Strategic Implications for Medtech Firms

Hospital decision-makers are the most important stakeholder in the Buyer’s Journey as they can make or break the possibility of achieving sales targets or securing a tender. With hospital medical technology being a high-impact investment, it is important for decision-makers to make the right choice. The insights in LEK Consulting’s report can help redirect the sale strategy.

What are the spending and strategic priorities?

With regards to medical technology, the top spending priorities for APAC hospitals are:

Ensuring that ease-of-use and convenience for the healthcare professional is highlighted in the sales pitch will spark the interest of the customer. If your technology can be used with the patient in the room, such as point-of-care testing, or provides direct benefit to the patient, this will add further value.

The top strategic priorities for APAC hospitals are:

Communicating that your technology will help healthcare professionals do their job more efficiently is key. If your technology is highly accurate, quick to return results or has a user-friendly interface, make sure this stands out in your pitch.

Another key consideration is support with maintaining the technology or equipment (46% of respondents), so ensuring hospital decision-makers are aware of the technical support your company can offer is crucial.

Who are the main hospital decision-makers in APAC?

According to the report, the decision-maker to approach depends on the type of equipment you are selling.

Depending on the type of technology you are selling, the focus will need to be on a specific decision-maker to ensure your sales pitch is getting the cut-through it deserves.

How to engage with decision-makers

Virtual interactions with medical technology sales representatives are now generally accepted across the APAC region, with the increase in these types of meetings during the peak of the COVID-19 pandemic. However, retaining some in-person engagement alongside these virtual engagements is preferred by most geographies.

If the medical technology company can position themselves as a partner that helps the hospital achieve their goals rather than a supplier that simply sells them products, this will provide an added advantage in most APAC geographies surveyed.

Source: LEK Consulting

Source: LEK Consulting

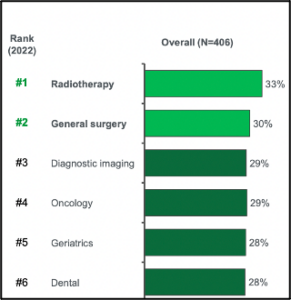

Key specialties for investment

Of the total respondents, 33% chose radiotherapy and 30% chose general surgery as specialties that will come first for spending. With elective procedures returning to pre-pandemic levels, it is no surprise general surgery was in the top three specialties selected.

If your business has multiple divisions, ensure that the teams focusing on the priority specialties are aware of this opportunity for sales. General surgery is also a broad term that includes a wide array of medical technologies.

Source: LEK Consulting

Source: LEK Consulting

Following the Buyer’s Journey

As with any high-value, high-consequence sale, ensuring that the content being served the prospect is in-line with their position in the Buyer’s Journey is critical. Asking too much of a customer early on in their Journey, such as at the Awareness stage, could result in a cold lead.

Equally, not providing an already qualified lead with the right information could let them slip away to a competitor who is ready for the kill.

Read our article on how IVD and medical technology companies can Attract, Engage and Delight their prospects

Digital content can be prepared for each state of the Buyer’s Journey so your sales team is armed with the right tools. Customer segmentation must be conducted beforehand to gauge at what stage of the Buyer’s Journey the prospect is at.

Acknowledgments

Thank you to LEK Consulting for preparing this in-depth report that will impact companies in the medical technology and diagnostics industry of Australia.